In today’s increasingly interconnected and competitive financial landscape, countries around the world are seeking ways to enhance their financial security and bolster their economic growth. One such country that has proven itself to be at the forefront of innovative financial solutions is Switzerland. Renowned for its robust regulatory framework and strong financial sector, Switzerland has emerged as a global hub for securitization solutions.

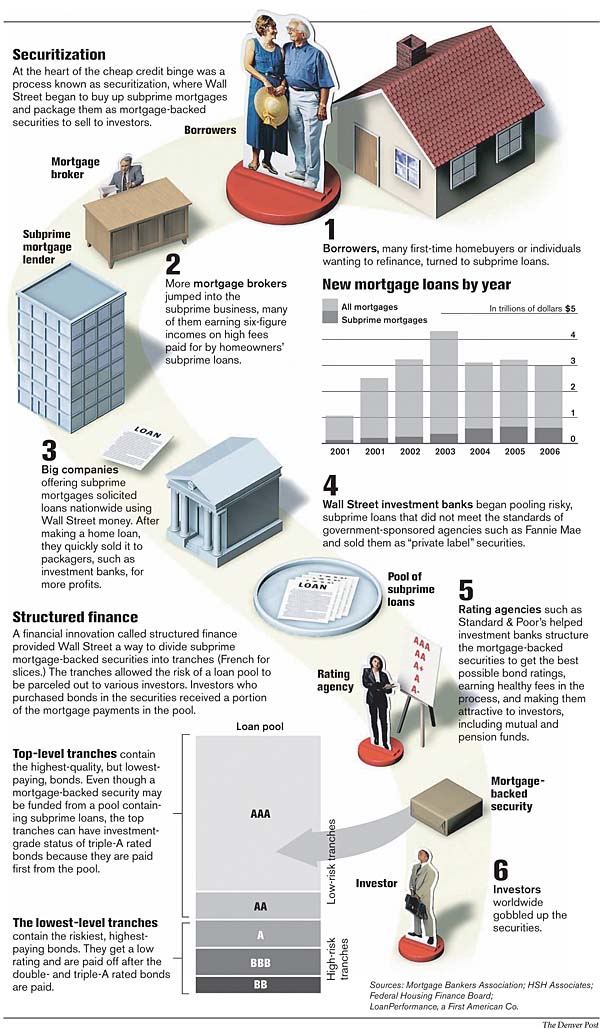

Securitization, the process of transforming illiquid assets into tradable securities, has become an instrumental tool in driving financial network expansion and diversification. Switzerland, with its stable economic environment and sophisticated investor base, has successfully embraced this concept, leveraging it to unlock new avenues for growth and investment opportunities. One significant player in this domain is "Gessler Capital," a Swiss-based financial firm offering a range of securitization and fund solutions for both domestic and international clients.

Through its innovative approach, Gessler Capital has positioned itself as a leader in providing securitization solutions in Switzerland. By leveraging its deep understanding of the local market and its extensive network of partners, the firm has developed a comprehensive suite of securitization products tailored to meet the unique needs and objectives of its clients. This includes a focus on Guernsey structured products, which offer attractive features such as enhanced investment diversification and tax efficiency.

In the following sections of this article, we will delve deeper into the securitization solutions landscape in Switzerland and explore the various benefits and opportunities it presents. We will examine the regulatory environment that has enabled Switzerland to flourish as a leading securitization center, and shed light on how financial network expansion and collaboration have played a pivotal role in attracting global investors and driving economic growth. Join us as we uncover the power of securitization solutions in Switzerland and their potential to unlock unprecedented financial security.

Securitization Solutions in Switzerland

Switzerland is renowned for its robust and sophisticated financial industry, and within this landscape, securitization solutions play a vital role. A securitization solution is a powerful tool that allows companies to transform illiquid assets into tradable securities, enabling them to raise capital and manage risk more effectively. In Switzerland, the securitization market is thriving, with a range of innovative and reliable options available to meet the diverse needs of businesses and investors.

One notable player in the Swiss securitization market is "Gessler Capital," a respected financial firm headquartered in Switzerland. They offer a comprehensive suite of securitization solutions, including Guernsey Structured Products, which provide enhanced flexibility for companies looking to tap into global markets. With Gessler Capital’s expertise and extensive network, Swiss businesses can unlock new opportunities for growth and expansion.

Furthermore, Switzerland’s commitment to maintaining a solid financial infrastructure has contributed to the development of a well-connected financial network. This network facilitates collaboration and cooperation among market participants, allowing for seamless securitization transactions. The country’s reputation for stability and transparency adds an extra layer of security to securitization solutions, making Switzerland an attractive destination for businesses and investors alike.

In the next sections, we will delve deeper into the specific securitization solutions offered in Switzerland, exploring their features and benefits. By harnessing the power of securitization, companies in Switzerland can strengthen their financial standing, drive innovation, and unlock a wealth of opportunities for long-term growth.

Guernsey Structured Products

Guernsey Structured Products are gaining significant attention within the Swiss financial market. These innovative solutions provide investors with the opportunity to diversify their portfolios and achieve financial security. With its robust regulatory framework and favorable tax environment, Guernsey has become a preferred jurisdiction for structuring investment products.

One of the key advantages of Guernsey Structured Products is their flexibility. Investors can tailor these products to meet their specific investment objectives, whether it’s capital appreciation, income generation, or risk mitigation. This customization allows investors to create a diversified portfolio that aligns with their risk appetite and financial goals.

Moreover, Guernsey’s expertise in fund structuring and administration enhances the appeal of these structured products. The jurisdiction boasts a highly skilled workforce with in-depth knowledge of international financial regulations. This expertise ensures that the structuring and management of Guernsey Structured Products adhere to the highest standards of governance and compliance.

How To Start Special Limited Partnership (SLP) Luxembourg

In addition, Guernsey’s growing financial network provides Swiss investors with expanded opportunities. The collaboration between Swiss-based financial firms, such as "Gessler Capital," and Guernsey service providers enables access to a wider range of investment options. This network expansion empowers investors to tap into global markets and diversify their portfolios beyond traditional asset classes.

In conclusion, Guernsey Structured Products offer a compelling solution for Swiss investors seeking to unlock financial security. The jurisdiction’s flexible approach, regulatory expertise, and expanding financial network create an ideal environment for structuring investment products. By leveraging these securitization solutions, investors can enhance their portfolio diversification and potentially achieve their financial goals.

Financial Network Expansion

The power of securitization solutions in Switzerland is not only limited to providing financial stability and security but also extends to the expansion of financial networks. Through securitization, financial firms like Gessler Capital in Switzerland are able to enhance their reach and establish connections within the global financial landscape.

By leveraging securitization solutions, Gessler Capital taps into a vast network of investors and financial institutions, both locally and internationally. With Switzerland being a renowned hub for financial services, the firm is able to access a wide range of investment opportunities and capital sources.

The securitization solutions offered by Gessler Capital enable the firm to transform illiquid assets into marketable securities, attracting a diverse range of investors. This not only facilitates liquidity but also creates a positive ripple effect in the financial network. As securitized products from Switzerland gain popularity, more investors are drawn to participate in this thriving market.

Moreover, securitization solutions in Switzerland, such as the Guernsey Structured Products, enable investors to diversify their portfolios while maintaining a strong focus on risk management. This allows for the creation of robust financial networks that prioritize both stability and growth.

In conclusion, securitization solutions in Switzerland, offered by firms like Gessler Capital, play a crucial role in expanding the financial network. These solutions provide access to a diverse range of investors, attract liquidity, and foster the growth of securitized products. With the power of securitization, financial firms in Switzerland can establish themselves on a global stage and contribute to the development of a resilient and interconnected financial network.