Welcome to the world of business finance, where numbers and strategy intertwine to shape the success of organizations both big and small. Understanding the intricate workings of business finance is essential for entrepreneurs, managers, and even individuals seeking financial growth in their personal lives. In this comprehensive guide, we will delve into the art of financial mastery and explore the key principles and practices that pave the way to unlocking success in business finance.

At the core of every thriving business is a solid financial foundation. From creating a business plan to managing cash flow, navigating financial statements, and predicting market trends, there are numerous aspects to consider when it comes to business finance. This guide aims to provide you with valuable insights and practical knowledge to navigate these complexities, empowering you to make informed decisions and maximize your financial potential.

Additionally, we will explore the intricacies of business tax law, a crucial aspect that can greatly impact the financial health of any organization. Understanding the nuances of tax laws and regulations is vital for businesses to optimize their tax planning strategies and ensure compliance. With our comprehensive business tax law guide, you’ll gain a deeper understanding of tax obligations, deductions, credits, and other tax-related considerations that can significantly impact your bottom line.

Embark on this enlightening journey as we unravel the art of financial mastery and equip you with the knowledge and tools to take control of your business finance. Whether you’re a seasoned entrepreneur or just starting out, this guide will serve as a valuable resource to enhance your financial acumen and pave the way for a prosperous future. Let’s dive in and unlock the secrets to success in business finance and tax law.

Understanding Business Finance

In order to achieve success in the realm of business, understanding the basics of business finance is crucial. Business finance encompasses a wide range of financial activities and decisions that are essential for running a successful enterprise. From managing cash flow to making strategic investment decisions, having a grasp on business finance is integral to unlocking success in the corporate world.

One aspect of business finance that requires attention is understanding various financial statements. These statements provide a snapshot of a company’s financial health and are essential for making informed decisions. By analyzing balance sheets, income statements, and cash flow statements, business owners can gain insights into the profitability and liquidity of their organization.

Additionally, having knowledge of business tax laws is vital for effective financial management. Business tax laws are constantly evolving, and staying informed about the latest regulations can help businesses minimize tax liabilities and optimize their financial strategies. By understanding these tax laws, businesses can ensure compliance while also taking advantage of any available deductions or incentives.

In summary, a solid understanding of business finance is paramount for achieving success in the corporate world. By being familiar with financial statements and staying up-to-date with business tax laws, entrepreneurs can make more informed decisions and navigate the complexities of the financial landscape with confidence.

Navigating Business Tax Law

In the complex world of business finance, understanding and navigating business tax law is essential for success. Compliance with tax regulations is not only a legal requirement but also a crucial factor in maintaining financial stability and maximizing profitability. This guide will provide you with an overview of business tax law and highlight key considerations to keep in mind.

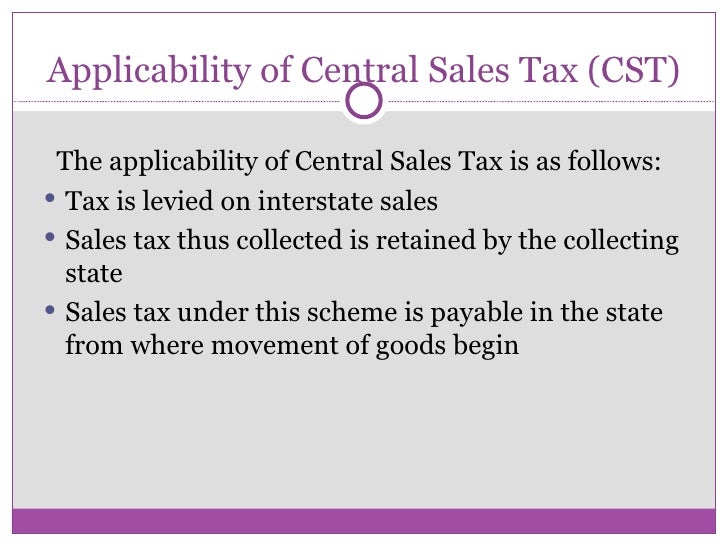

First and foremost, it is important to grasp the fundamental concepts of business taxation. Businesses are subject to various types of taxes, including income tax, sales tax, payroll tax, and more. Each tax has its unique rules and regulations that govern how it is calculated and paid. Familiarizing yourself with these tax types and their specific requirements is essential for ensuring accurate and timely tax reporting.

Additionally, staying up to date with changes in tax law is crucial. Tax regulations are dynamic and subject to frequent updates and revisions. Keeping abreast of these changes can help you avoid non-compliance issues and take advantage of any tax incentives or deductions that may be available to your business.

Lastly, seeking professional guidance is highly advisable when it comes to navigating the complexities of business tax law. Consulting with a qualified tax professional or accountant can provide you with expert advice tailored to your specific business needs. They can assist in tax planning, help you identify potential tax savings opportunities, and ensure that your tax filings are accurate and in compliance with the law.

By understanding business tax law, staying informed about changes, and seeking professional guidance, you can effectively navigate the intricate world of taxes and position your business for long-term success.

Keys to Financial Success

Effective financial management is crucial for the success of any business. By mastering the principles of business finance, entrepreneurs can navigate the complex world of money management with confidence. In this section, we will explore three key factors that can contribute to your financial success.

-

Strategic Planning: Developing a clear financial strategy is essential for long-term success. Start by setting realistic financial goals and outlining the steps required to achieve them. This includes creating a budget, forecasting cash flow, and identifying potential risks. Regularly review and update your financial plan to stay on track and adapt to changing market conditions.

-

Monitor and Control: To stay financially healthy, it is essential to monitor your business’s financial performance regularly. Keep a close eye on key financial indicators such as revenue, expenses, profitability, and liquidity. Use financial statements and reports to identify trends, spot areas of improvement, and make informed decisions. Implement internal controls to safeguard your assets and mitigate any financial risks.

-

Compliance and Tax Management: Understanding business tax laws is crucial for avoiding legal issues and optimizing your tax position. Stay up to date with the latest tax regulations and consult with tax professionals if necessary. Maintain accurate records of income and expenses, ensuring compliance with all reporting requirements. By effectively managing your taxes, you can minimize costs and maximize profits.

By incorporating these key principles into your financial management practices, you can unlock the path to success and ensure the long-term financial well-being of your business. Remember, financial mastery is an ongoing journey that requires continuous learning and adaptation to changing circumstances.