The cryptocurrency market has emerged as a transformative force in global finance, capturing the interest of investors and traders alike. In Nigeria, this market holds significant potential, driven by a tech-savvy population and increasing adoption of digital currencies. Understanding the intricacies of the cryptocurrency market in this context is essential for anyone looking to navigate its complexities effectively.

Current Trends in the Cryptocurrency Market in Nigeria

The Nigerian cryptocurrency landscape is characterized by rapid growth and evolving trends. A growing number of individuals are turning to cryptocurrencies as an alternative investment and a means of financial inclusion. This trend is particularly notable among the youth, who are increasingly seeking ways to leverage digital assets for wealth creation. Many Nigerians are also using cryptocurrencies as a hedge against inflation and currency devaluation. Given the volatility of the local currency, there is a heightened interest in digital currencies that offer the potential for greater stability and investment returns. Additionally, peer-to-peer trading platforms have gained traction, enabling users to buy and sell cryptocurrencies directly without intermediaries, thus enhancing accessibility.

How to Analyze Cryptocurrency Prices and Market Movements

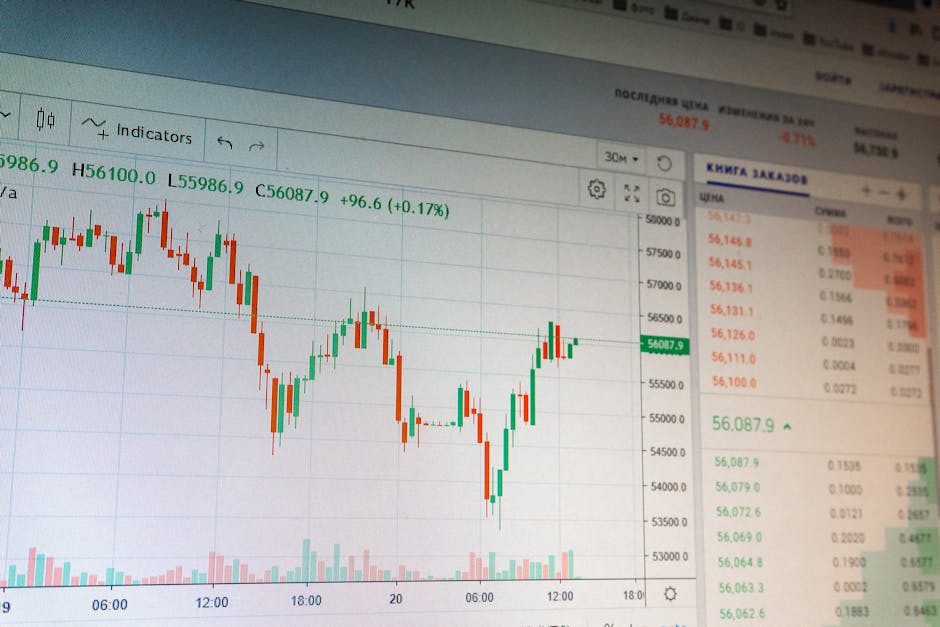

Conducting a thorough cryptocurrency market analysis involves several key steps. To begin with, traders should familiarize themselves with fundamental and technical analysis methodologies. Fundamental analysis focuses on evaluating the intrinsic value of a cryptocurrency based on factors like market demand, technological advancements, and the overall economic environment. On the other hand, technical analysis involves examining historical price movements and market trends to predict future price actions. Traders often utilize various tools and indicators, such as moving averages, Relative Strength Index (RSI), and candlestick patterns to inform their decisions. For those new to cryptocurrency trading, several resources are available, including online courses, webinars, and trading communities. Websites that aggregate cryptocurrency market data can also provide valuable insights into price trends and market capitalization, making them essential for effective analysis.

Practical Tips for Effective Cryptocurrency Market Analysis

1. Stay Informed: Regularly follow news and developments in the cryptocurrency space to understand market sentiment. 2. Utilize Analytical Tools: Use platforms that provide charts and real-time data for better decision-making. 3. Diversify Your Analysis: Combine both fundamental and technical analysis for a more comprehensive view of the market. 4. Monitor Trading Volumes: Pay attention to trading volumes as they can indicate the strength of a price move. 5. Engage with the Community: Participate in online forums and social media groups to gain insights from experienced traders.

The Impact of Local Currency Conversion on Cryptocurrency Trading

Local currency conversion rates play a crucial role in cryptocurrency trading strategies. In Nigeria, where the Naira often experiences fluctuations, understanding these dynamics is essential for traders. When converting local currency to purchase cryptocurrencies, exchange rates can significantly influence the overall cost and potential profit margins. Moreover, traders must be mindful of the costs associated with converting local currency into digital assets. High conversion fees can eat into profits, making it vital to choose the right platforms and services for currency exchange. Additionally, shifts in local economic conditions can lead to changes in demand for cryptocurrencies, further impacting trading strategies. To effectively navigate these challenges, traders should regularly review and analyze local currency trends and their implications on the cryptocurrency market. Adapting trading strategies in response to these fluctuations can enhance profitability and minimize risks.

| Aspect | Details |

|---|---|

| Market Growth | Increasing adoption among youth |

| Investment Motivation | Hedge against inflation |

| Trading Method | Peer-to-peer platforms |

| Analysis Tools | Charts, indicators, community feedback |

In conclusion, effective cryptocurrency market analysis is crucial for anyone looking to engage in trading within Nigeria. By understanding the current trends, employing analytical tools, and considering local currency dynamics, traders can make informed decisions that enhance their trading success. For those looking to deepen their understanding of cryptocurrency and its market dynamics, platforms like Monica Cash provide valuable resources and insights tailored to the unique challenges and opportunities within the cryptocurrency landscape.